The BRICS are not what they were. Maybe it is time to look elsewhere.

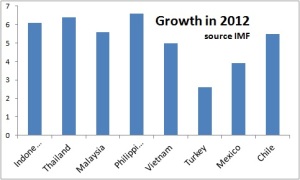

Take news out this morning. According to Capital Economics, growth in GDP across emerging markets may have fallen to a three year low. Other data revealed that the Brazilian economy grew by just 0.6 per cent in Q1. But despite the lacklustre growth, fears over inflation have forced Brazil’s central bank to up interest rates by half a per cent. Looking at other data out today revealed that the economy of the Philippines grew by 7.8 per cent.

The BRICS have problems. China is struggling to adjust from a growth model that relies on exports and investment to one that grows off the back of consumer spending. In short China needs more internal impetus for growth. Brazil’s problem is the opposite: too much reliance on consumers and not enough investment.

News on the Indian economy has been a disappointment, as the country fails to make the reforms necessary to compete on the international markets. As for Russia, it remains over-reliant on oil and gas and Capital Economics forecasts it will grow by just 2.3 per cent this year.

In contrast, the TIMPs – that’s Turkey, Indonesia Mexico and the Philippines – look a lot more interesting. As indeed does Malaysia, Thailand, Vietnam, Chile, Columbia and parts of Central America – such as Panama.

The stock markets of the Philippines and Thailand have been the second and third best performing in the world during the last two years. (Venezuela was first, but this market is small and very illiquid.)

Stock market growth does, of course, bring with it the risk of stocks rising too high. The Philippines’ stock market is trading on a valuation of around 20 times 2013 earnings, but less than the p/e ratio seen before the Asian crisis in 1997.

The Asian crisis of 1997 rocked the South East Asian region hard. Are we in danger of seeing a repeat of this episode? This time around there is a difference. The savings ratio in Singapore last year was 49 per cent of GDP, and 39 per cent of GDP in Malaysia.

The biggest economy in the region is Indonesia. Some reports have suggested a credit bubble may be forming in the country. It may be worth pointing out that in Indonesia the ratio of credit to GDP is 30 per cent, against an average of nearer 100 per cent for the region. More interestingly, in Indonesia a smaller proportion of credit has funded projects in the property sector, relative to Hong Kong and Vietnam, for example.

As a result there is little hint of a property bubble in the making. Instead, much of the credit has funded infrastructure and manufacturing. In 1997 around 50 per cent of Indonesia’s credit was funded by foreign currencies. Today that level is nearer 15 per cent.

© Investment & Business News 2013