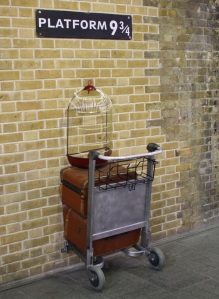

There is a university, its location is not well known, maybe you travel there from platform nine and three quarters at King Cross, but it is called the School of Technology Phobia. While we don’t know the location, it does seem likely that the University of Luddites is nearby. Graduates from the former of these institutions have been busy during the last few days, pouring their scholarly ideas across the ether. As a result, shares in Apple look like they are on helter-skelter, hurtling towards the earth.

That may be little unkind. That is to say unkind on Apple. It remains the world’s largest company and its shares did not so much as tumble, as reverse some of the stellar gains seen in recent months. But for the ladies and gentlemen whose cynicism led to the shares falls, the words are not all unkind at all.

Shares in Apple fell, and they fell quite sharply this week, as the company revealed truly stunning results. Revenue was up 112 per cent, sales into China doubled. If the Apple share price falls after results like that, one wonders what might happen if it had an normal set of results

Apple’s problem is that it is the world’s biggest company by market cap. When you are that big it is hard to grow. Apple needs products that command high retail prices and it needs to sell them in droves. That’s why some think it will be turning to cars next, or even into the world of energy generation and storage. The iPhone did alright in Apple’s latest quarter, in fact sales were up 35 per cent. According to the school of thought most people sign-up to, a 35 per cent rise in sales of any product is considered pretty exceptional. It is just that when it comes to Apple, it seems many analysts and investors went to a different school, the one mentioned above.

One day, but we have no idea when, smart phones will stop selling. Maybe it will occur when Moore’s Law runs out of puff, maybe it will occur when smart phones are replaced by chips that sit inside our heads. So while Apple enjoyed revenue topping £13.2 billion in its latest quarter, and its valuation to projected earnings is nothing alarming, cynics fret that one day it will run out of road. Contrast that with Exxon Mobil, Apple’s main rival for the tile world’s largest company, it specialises in a product that the world will always want, namely oil, or so goes the argument.

As it happens, with technology advances in renewables, energy storage and synthetic oil there is no guarantee the world will always want Exxon Mobil’s core product. Apple, however, has another advantage. To explain why we need to look at psychology.

When it comes to paying for stuff, our purchases are likely to be greater if there is distance. It also helps if things are easier.

If you were to tuck into pizza at the local Pizza café, and you were charged by the bite, you might soon get fed up. Setting aside the inconvenience, with each bite you will be thinking about the cost. So you pick you your fork, move the pizza to your mouth, and quickly tap in your pin number authorising another 30 pence. As you munch away, you will be thinking about the cost. Dan Ariely prosed the pizza idea to explain the concept of the ‘pain of paying’.

Other research shows that people who live in apartments in New York spend more on their laundry if they pay by tokens than by coins. The same psychology explains why casinos provide customers with chips – They spend more money that way.

For similar reasons, we spend more when we use a credit card than when we use cash. The lower the ‘pain of paying’, it appears the more we pay.

Now consider Apple Pay. It will be to the ‘pain of paying’, what morphine is to a headache. Apple Pay will make money for retailers, and Apple will be paid handsomely for this by them in return.

Now consider the Apple watch. It’s odd, isn’t it? When was the last time you used a pocket watch. Wrist watches replaced pocket watches because they were more convenient. Odd then, that critics of the Apple Watch, which is after-all— a computer to sit on your wrist, don’t get why it is had advantages over a pocket smart phone. There is another benefit. As Daniel Kahneman illustrated in his book Thinking Fast and Slow, we can be quite impulsive. If spending money involves touching our wrist, and if that money is then distanced from our bank account by Apple Pay, we are likely to spend more

It is just another reason why we need to listen to graduates from the schools of technology not, technology phobia.